The number of family caregivers is rising across North Carolina, and so are the financial and health costs borne by the people providing that care, according to the National Alliance for Caregiving and AARP in a joint report.

Advocates say new Medicaid work requirements could intensify those pressures unless the state takes deliberate steps to protect caregivers’ coverage.

The warning came during the most recent monthly meeting of the NC Coalition on Aging, where presenters outlined the state of family caregiving nationwide and statewide, as well as the role Medicaid plays in supporting caregivers.

The state of caregiving, by the numbers

The joint report, “Caregiving in the US 2025”, revealed that the number of caregivers in the United States has grown to 63 million Americans, or one in every four adults. The increase is 45 percent higher than a similar 2015 survey at 43.5 million Americans.

As caregiving demand has expanded nationwide, federal lawmakers have approved new funding aimed at caregiver support. The 2026 fiscal appropriations bill passed by the U.S. House allocated $200 million to family caregiving programs; the bill is awaiting approval by the Senate.

The National Alliance for Caregiving stated it was “encouraged by the growing recognition from Congress” but noted that the recognition “must be matched with resources. In a caregiving appropriations analysis, the nonprofit highlighted that nearly 10,000 Americans turn 65 every day, making current funding levels insufficient as demographic pressure grows.

“Support systems are expanding. That’s great, but the demands on family caregivers are growing faster than the services and supports can keep up with,” said Kim Cantor, National Alliance for Caregiving CEO.

Some of those demands include the complexity of care that’s provided, with more than 40 percent of caregivers providing high-intensity care. That level of care includes complex medical tasks like administering injections or managing equipment, or tasks required for daily living such as bathing or toileting.

“You are providing care for multiple people or an individual that has more than one condition,” Cantor explained.

That intensity can have an increased strain on the caregivers themselves. In North Carolina, where one quarter of adults (27 percent) are family caregivers, currently providing care to a family member or friend or had provided care within the last year, the report found:

- Over half of family caregivers (54 percent) in North Carolina have experienced at least one negative financial impact because of their care responsibilities. Common reported negative impacts include stopping saving, taking on more debt or leaving bills unpaid.

- One in six family caregivers experience seven or more days a month of poor physical health. Two in five caregivers (40 percent) experience high emotional stress while caregiving. One in five (19 percent) have difficulty taking care of their own health while they focus on their care recipient’s needs. Nearly one quarter (24 percent) feel alone while caregiving.

- Three in ten family caregivers (31 percent) have difficulty getting local affordable services like delivered meals, transportation or in-home health services.

- Six in ten family caregivers work while also caregiving (58 percent), and 27 percent of caregivers spend at least 40 hours a week providing care or provide constant care.

“Working caregivers face greater financial strain than nonworking caregivers. To me, that’s a really interesting nugget when you start talking about community engagement requirements — work requirements,” Cantor said.

“What is the experience of someone who’s working while they’re caregiving?” she asked. “What is the value of family caregivers in North Carolina, and what do they bring to help really uphold and buttress the system that we have.”

Caregivers, Medicaid and work requirements

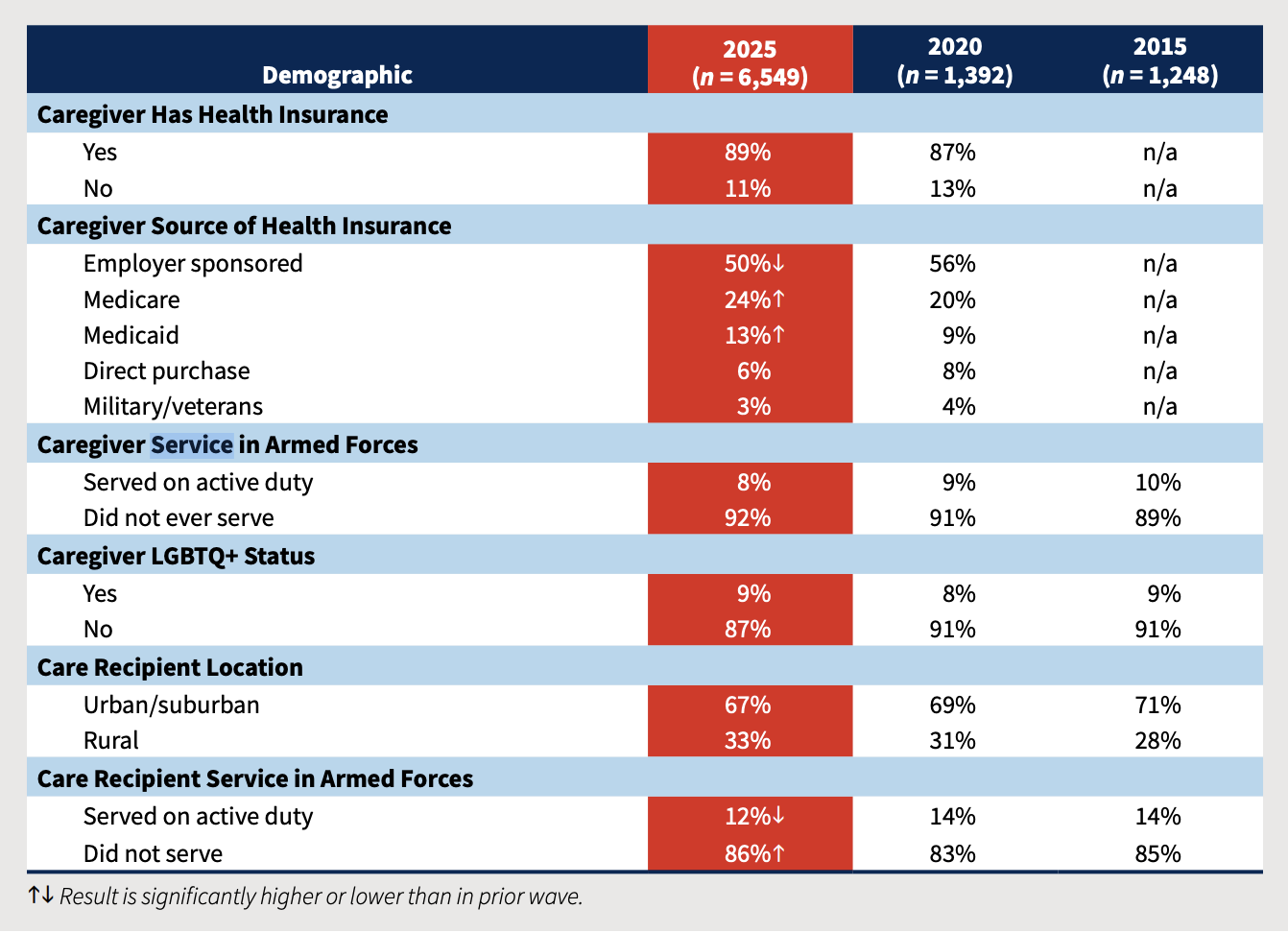

Family caregivers make up a sizable share of the Medicaid population and rely on the program to stay healthy enough to continue providing care. Of the 63 million family caregivers nationwide, about 7.3 million are adults ages 18 to 64 who receive their own health coverage through Medicaid, according to AARP. That means nearly 12 percent of caregivers younger than 65 depend on Medicaid to maintain their own health while managing the physical and emotional demands of caregiving.

“North Carolina’s family caregivers are really the backbone of the state’s long term care system, and Medicaid coverage really supports their ability to keep providing care,” said Edem Hado, senior policy and research manager at AARP Public Policy Institute. “And now we have new federal Medicaid policy changes that create a risk challenge around coverage disruptions.”

Under the One Big Beautiful Bill Act, adult Medicaid beneficiaries ages 19 to 64 must meet community engagement requirements — typically 80 hours per month of work, training or other qualifying activities — unless they qualify for an exemption. Federal law explicitly exempts family caregivers, but the responsibility for identifying exempt enrollees and preventing coverage loss is up to the state.

“The exemption is clear in statute,” Hado said. “But really the risk lies in the implementation and whether states can identify caregivers consistently and also protect their exception.”

Advocates said that continuous coverage is vital to caregivers’ ability to manage their own health while maintaining a high level of care. Medicaid coverage allows those caregivers to access preventative care, manage chronic conditions and receive mental health support for themselves.

“When caregivers lose coverage, or face gaps in coverage, it can really reduce their capacity,” Hado said. “It also increases the risk of nursing home placement for older adults and drives up costs for Medicare, Medicaid and state budgets.”

According to the 2024 annual survey conducted by Genworth — a long-term care insurance company — the median cost for a semi-private room in a North Carolina nursing home is $8,821 per month.

While states are required to implement and carry out the new federal policy, the way it’s done can help reduce the burden on family caregivers, according to the AARP Public Policy Institute.

“States have a lot of flexibility for exactly how they do it, and this has really strong implications for family caregivers and other types of enrollees,” said Brendan Flinn, director of long-term services and supports at the institute.

What advocates are urging the state to do:

- Keep verification simple: Limit work-requirement or exemption verification to a single month for new and existing Medicaid enrollees to reduce administrative barriers and prevent procedural coverage loss.

- Automatically protect eligible caregivers: Use existing data sources to identify family caregivers and apply exemptions without requiring additional paperwork whenever possible.

- Make reporting accessible: Allow caregivers to report their status through multiple, easy-to-use options — including online, phone, mail and in-person — with minimal documentation.

- Invest in clear, targeted outreach: Proactively inform enrollees that family caregivers are exempt from work requirements and explain how to claim that exemption before coverage is at risk.

“This work requirement policy does really underscore the importance of having open lines of communication between state agencies and the different supporting organizations and providers to help kind of reduce churn, really reduce administrative burden,” Flinn said.

This article first appeared on North Carolina Health News and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.![]()